Overview

A credit rating is an independent assessment of the creditworthiness of an entity, a bond, or any similar borrowing instrument. It measures the probability of the timely repayment of principal and interest of a debt obligation by the issuer. Generally, a higher credit rating leads to a more favorable effect on the marketability of a bond, likely reducing the interest rate and the resulting debt service to the State. Long-term credit rating symbols are generally assigned with "triple A" as the highest and "triple B" (or Bbb) as the lowest in investment grade. Anything below triple B is non-investment grade, and is commonly known as a "junk bond."

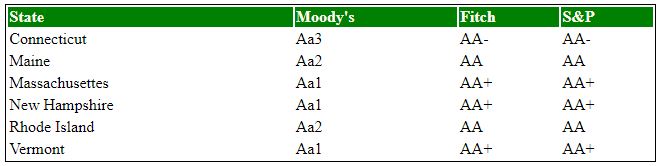

Bond Ratings of New England States

The major credit rating agencies are Moody's Investors Service, S&P Global Ratings and Fitch Ratings. As of April 2021, Vermont is rated Aa1 by Moody’s, AA+ by S&P, and AA+ by Fitch.

Rating Agency Reports

Rating Agency Methodology for U.S. States

Transportation Infrastructure Bond Rating Agency Reports

Please note that all Transportation Infrastructure Bonds have been retired, redeemed or matured.

Special Reports